Subprime Auto Leads

GENERATE LOCAL SPECIAL FINANCE AUTO SALES LEADS ON DEMAND

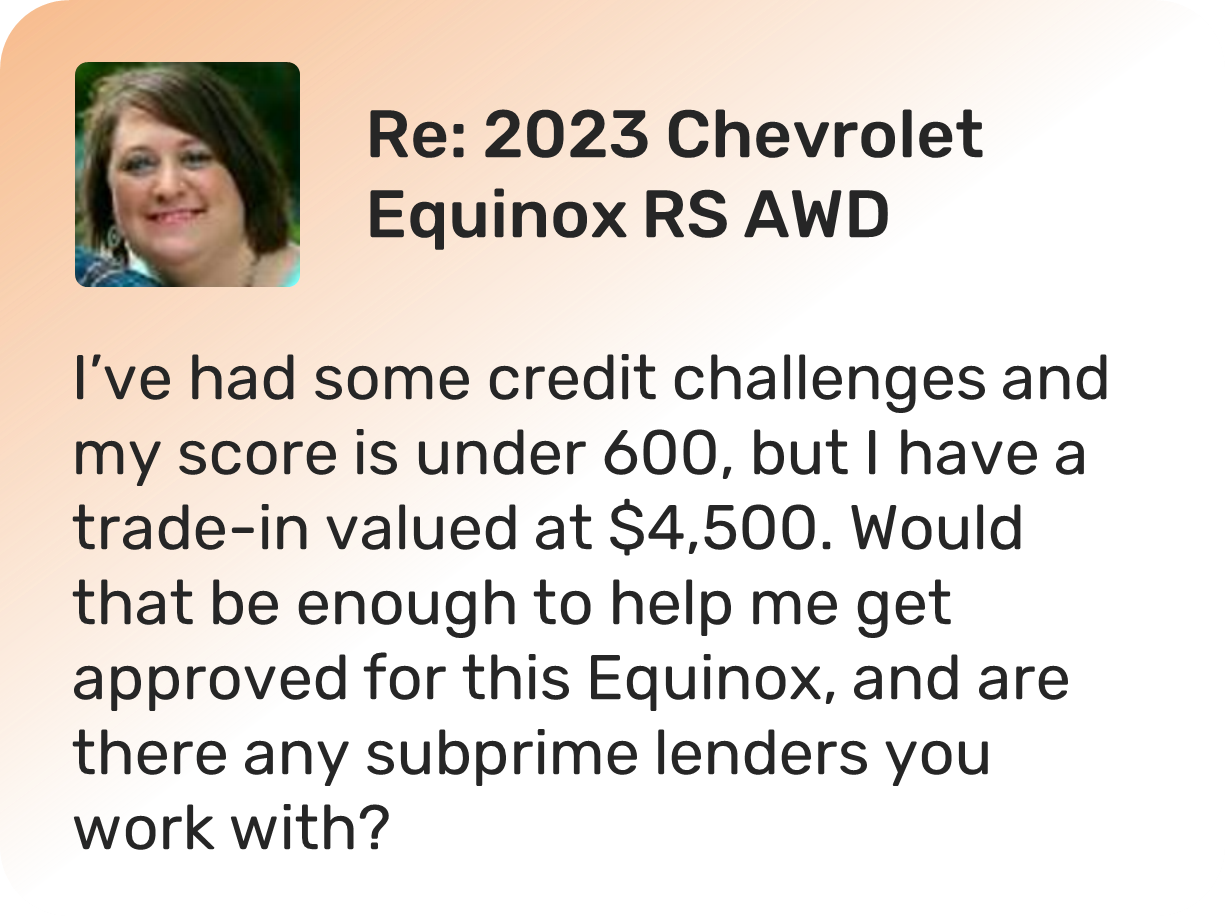

In today's market, not every car shopper has a perfect credit score. Offering financing to clients with subprime credit scores is a sure way to capture market share and generate more revenue for your store.

At LeadLocate, we are committed to offering our dealer partners the most effective subprime lead generation technology on the market today, and that starts with source transparency. When you open a subprime lead generation account, we will configure our software backend to target specifically car shoppers who are showing interest in getting a loan as second-chance credit borrowers. We use an omnichannel lead generation strategy targeting these shoppers across the web with messages that are relatable to individuals who know they cannot qualify for prime tier A credit auto financing.

The leads are captured from search engines, in-app advertisements, video ads, for-sale-by-owner retargeting, special finance landing pages, and many other sources. LeadLocate software is also capable of synchronizing and processing your current leads through our channels if you want to manage all of your leads in one place. Plus, you get all the marketing and CRM features that you could possibly need included with every subscription. And if you want our finance leads pushed over to your own CRM, this can be easily done through the settings page of your account in one click.

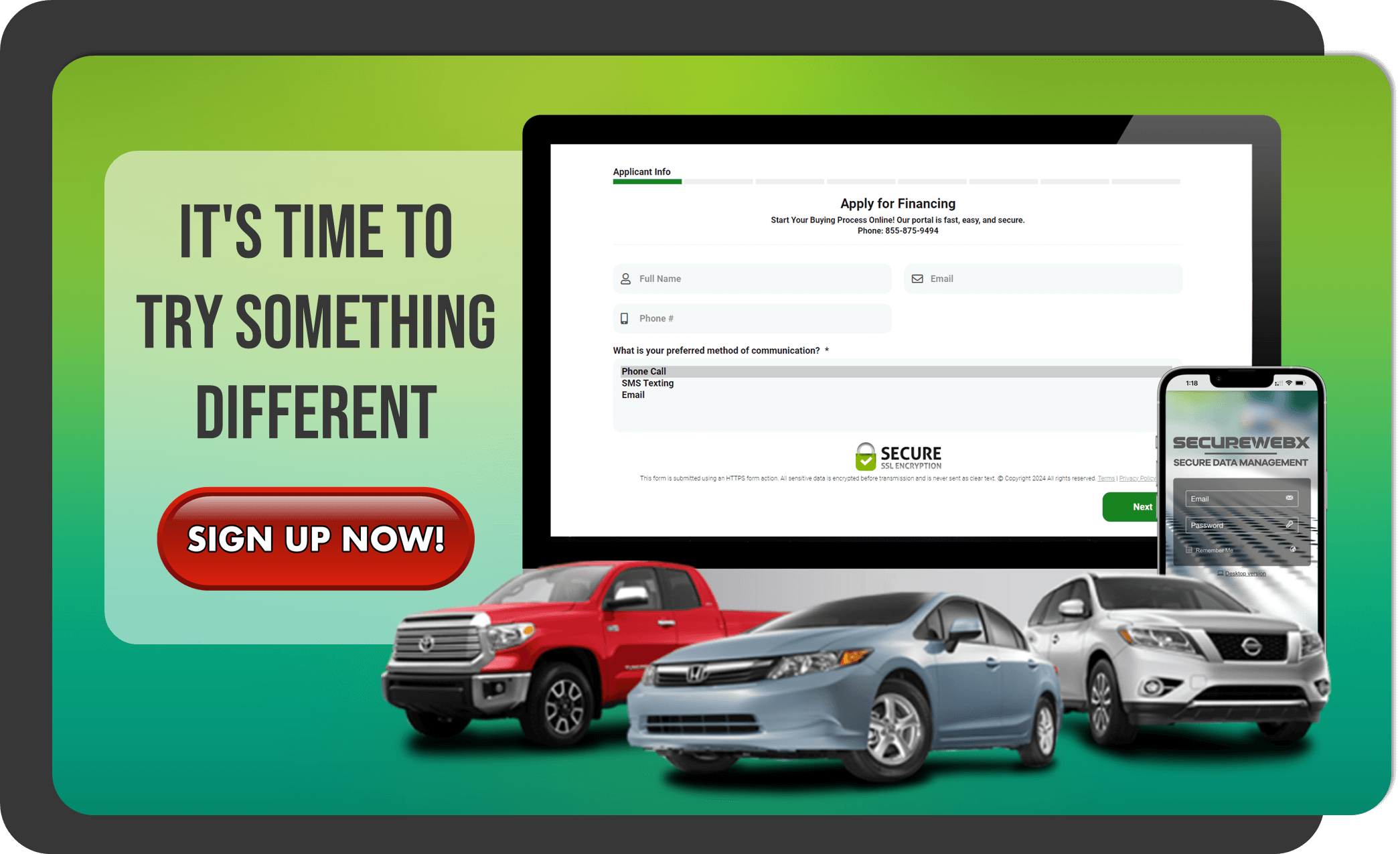

Our special finance auto leads are everyday car shoppers looking to purchase a daily driver. The main objective of our process is to capture car shoppers that you would have otherwise missed. That is why we concentrate on the mass market and set up prescreening process questions that will help you weed out tire kickers and visitors who are just looking around. And with our quality control procedures, you can be sure that any bad leads that you receive do not count against your lead count for that month. To sign up for an account, just click on "sign up" at the top of our website and submit your application. It will take us about 3-4 business days to set up your account, and when your account is fully activated, one of our account managers will give you a call to schedule your first training call to show you around the software.

REQUEST A CALL BACK

For faster service, dial 844-376-2274 and ask to speak to an available account manager.

TALK TO MORE CAR SHOPPERS EVERY DAY

EXPERIENCE SUSTAINABLE FINANCE LEAD GENERATION PROCESS FROM DAY ONE

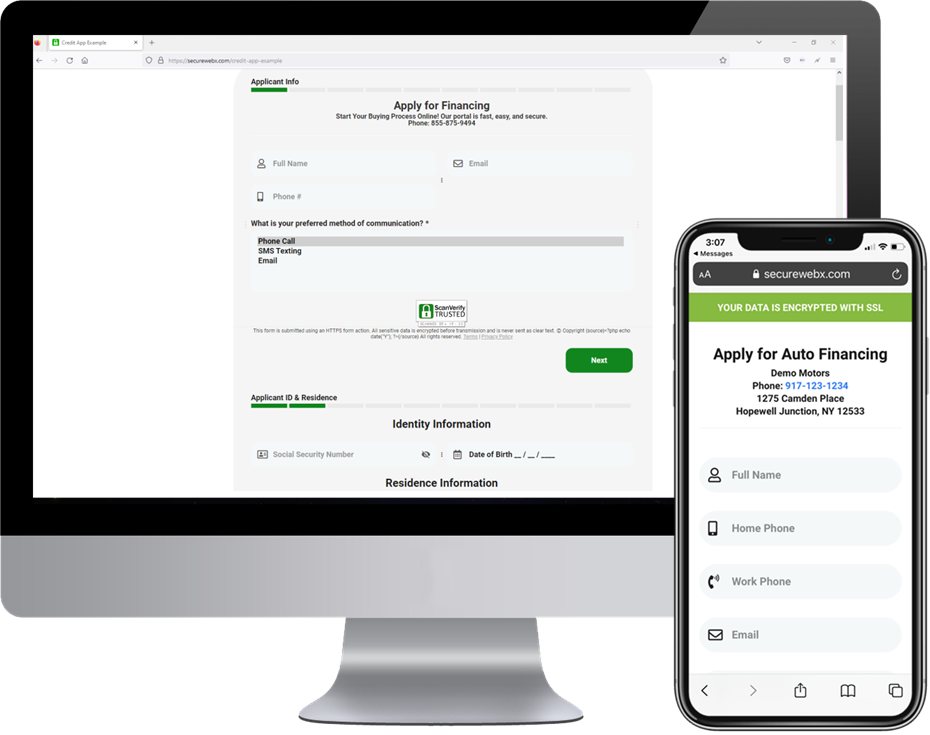

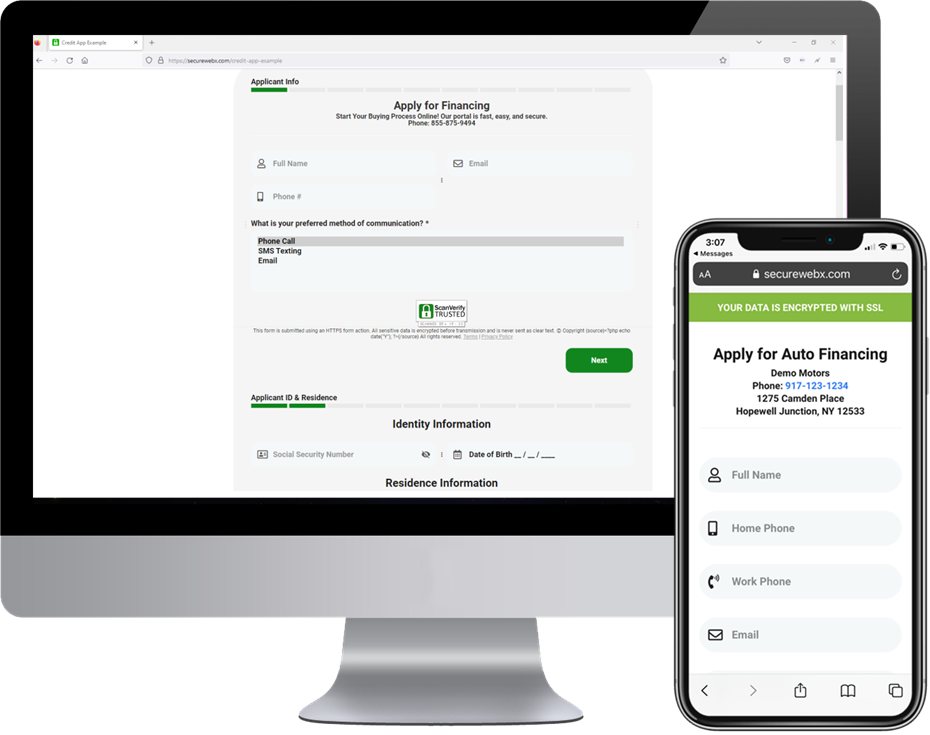

LEAD FORMS & APPLICATIONS

Each lead has multiple ways to contact you through forms, full credit applications, SMS, chat, or phone calls. This way, clients use the channels they are most comfortable with.

KEEP THE PROCESS MOVING

As soon as you get a lead, you can start the sales process online by collecting any stips, like proof of income or employment verification, before the client gets to the dealership.

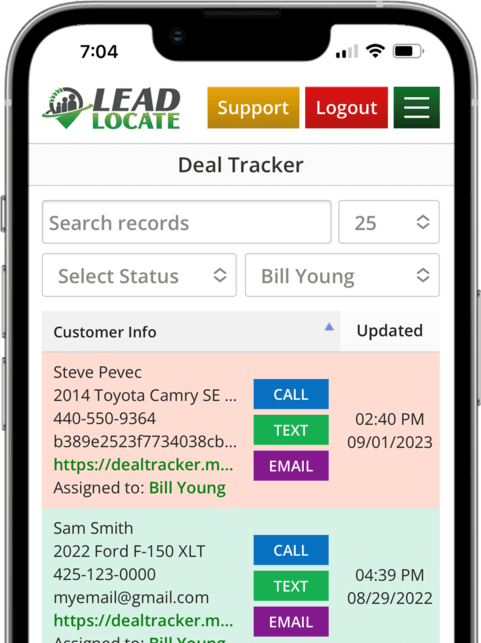

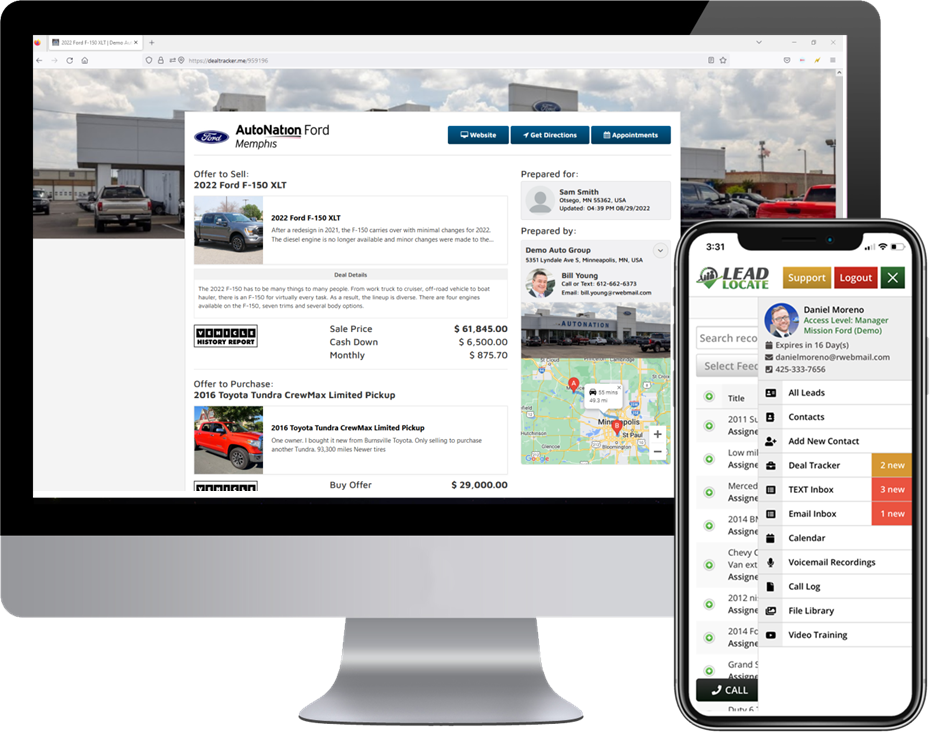

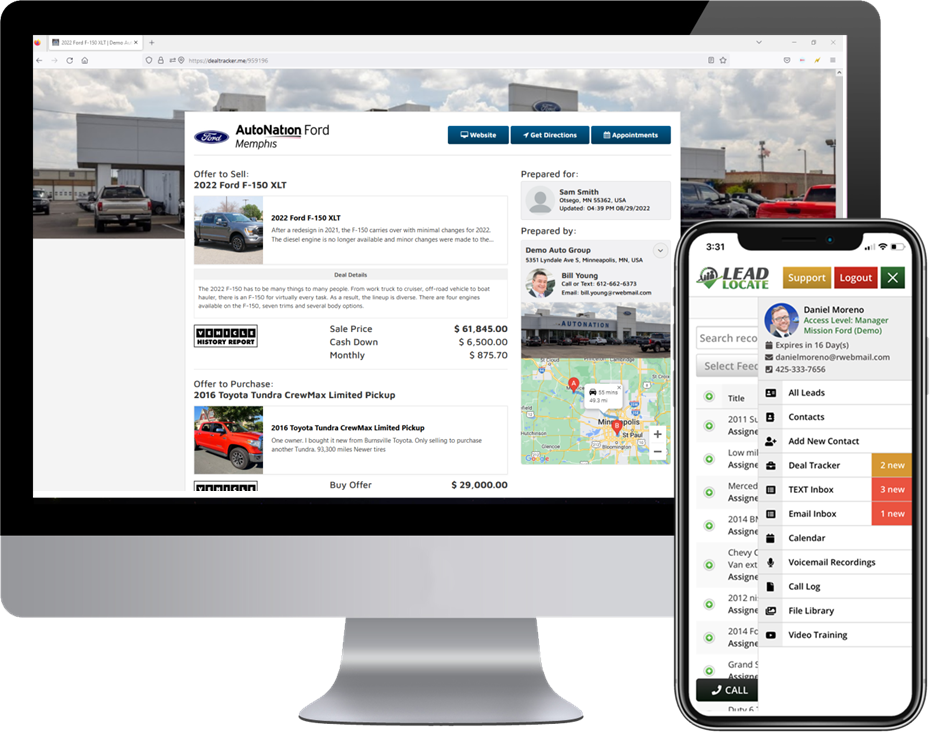

CLOSE DEALS ON THE GO

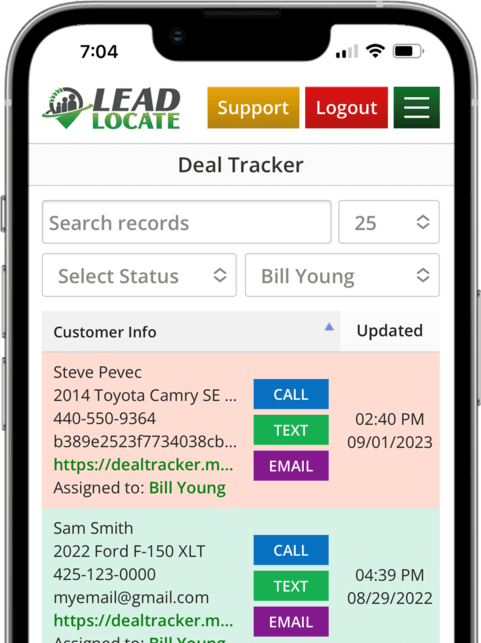

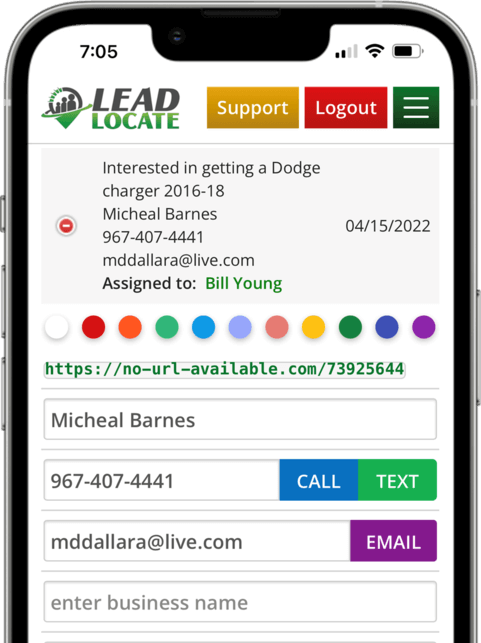

You can access and manage your LeadLocate account on your computer or mobile phone 24/7, giving you unmatched flexibility to sell more cars whether you are at the dealership or on the go.

SUBPRIME CAR SALES LEADS FOR DEALERS WITH SPECIAL FINANCE DEPARTMENT

Let us help you supplement your current subprime auto leads with in-market car shoppers looking for second-chance credit dealers and lenders.

As a car dealership owner, sales manager, or salesperson, you are constantly looking for people who are in the market to buy a car. And even though you use local advertising to bring in buyers who qualify for prime loans, this still isn’t enough business. This is where subprime car sales leads come in.

What are subprime car sales leads? Subprime auto leads are the names and personal contact information of people who are currently looking for a car but have poor enough credit that they cannot get a traditional loan. However, they do have good enough credit to get a subprime car loan. A subprime car loan is a higher-interest loan that requires a larger down payment from the buyer and is paid over a longer period of time.

This allows a person with bad credit to buy a car. They fill out an application online with their current information, which can include their email address, physical address, phone number, and current employer. This information is then sold to local car dealerships through a lead broker so the salesperson can contact them and get them to purchase a car.

Why would dealerships consider buying subprime car sales leads? Subprime car sales leads open up a whole new market for car sales. What could possibly be better than having local leads of people who qualify for subprime car loans and are motivated to buy a car? For a car dealership that needs sales, buying subprime car sales leads seems like a great idea. However, the information these companies are promising to sell you may not only be unhelpful but may also be inaccurate. Here are three problems you will encounter when you buy subprime car sales leads.

One of the things that these sales lead companies will tell you is that the sales leads in your area will only be sold to you exclusively. This may be true in theory, but what you may be buying is a list of names that have already been sold to every dealer in your state.

This is because auto sales lead companies get their leads from many, many different websites where a person who is desperate to get a car loan will give their information over and over to different application sites. So many local dealers will be contacting these people, whose names have been given out to other sales leads companies and sold to many other dealers over and over again as these people apply for loans on different websites.

Another problem is the accuracy of the information. People with bad credit tend to move a lot and often get their phones shut off. So, by the time you get the information, you probably won’t get a hold of anybody. Remember, these people are all running from creditors like you.

Finally, the sales lead company also has no way of knowing whether the person has purchased a car somewhere else or if their situation has changed and they are no longer looking for a car because the sales leads may be several months old or more. And there is also no guarantee this person has any money to make car payments, anyway.

Be careful when buying subprime auto leads from lead generation companies. In your area, how many people with bad credit do you think are looking for a car right now that you can actually help to make a purchase today? Do you have a ballpark figure? If so, when a lead company promises to give you many more leads than what you know is out there, they are probably giving you leads that are not as good as advertised.

NEED HELP CHOOSING A PROGRAM? CALL 844-376-2274

MARKETING AND CRM SOFTWARE TO SUPERCHARGE YOUR SALES

REAL-TIME

INBOUND LEADS

Month-to-Month Service

✅ Inbound Plans include integration with our advertising feeds that generate leads for you.

Generate fresh sales leads, get a personal website, capture leads through a referral link, automate marketing, and more.

MARKETPLACE

PROSPECTING

Month-to-Month Service

✅ Prospecting Plans include custom feeds for FSBO, organic, and sponsored seller leads.

Includes everything you need to buy vehicles directly from private sellers to resell on your lot or wholesale at an auction.

ALL-IN-ONE

HYBRID PLAN

Month-to-Month Service

✅ Hybrid Plans include both buyer and seller lead feeds with complete market coverage.

Talk to motivated sellers and generate exclusive buyer leads simultaneously with seamless pipeline management.

SETUP YOUR OWN LEAD CAPTURE PRESCREENING QUESTIONS

You choose what questions we ask your leads during lead capture

fast special finance car sales leads

READY TO SWITCH YOUR SUBPRIME AUTO LEAD PROVIDER? TRY LEADLOCATE INSTEAD

OMNICHANNEL TECHNOLOGY

We use omnichannel marketing technology to find local subprime car sales leads. You pay a flat fee per month with no surprises.

DIGITAL RETAILING SOFTWARE

Our digital retailing software is included with every subprime car leads account, so you can start selling cars from day one.

BUY MORE LEADS ON DEMAND

You decide how fast or slow you want your leads order to be delivered. Plus, we can customize your lead flow at any time.

WHY LEADLOCATE?

WE LIKE TO THINK OUTSIDE THE BOX OF THE TRADITIONAL CREDIT APPLICATION-ONLY MINDSET FOR SUBPRIME CAR SALES LEADS

Our subprime car sales leads are generated through a mix of paid and organic advertising targeting active in-market shoppers.

We verify that the customer is actively shopping for a vehicle. Every lead will be a live in-market car shopper looking to buy.

Every lead is exclusive and is generated for a specific account only. Leads are not sent to multiple dealerships or salespeople.

Inbound special finance leads work great for both internet subprime department and Buy Here Pay Here dealerships.

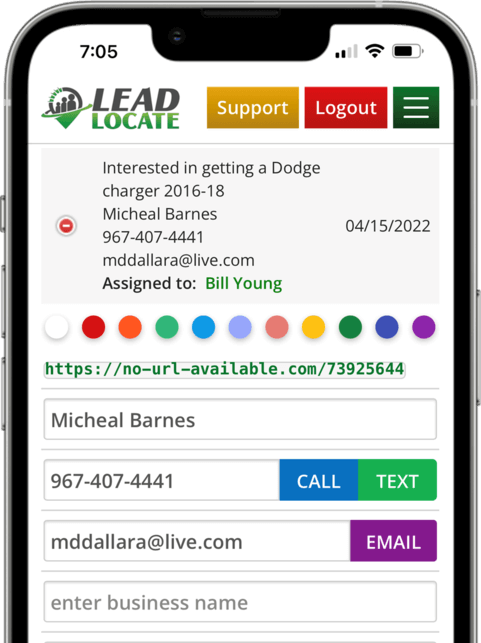

Our CRM system will instantly follow up with the lead for you, so you don't have to worry about manually sending the first message.

All lead replies are instantly pushed to your cellphone, so you will never miss a text or a call from your customer again.

We capture all the information you need to know to start a conversation, like the vehicle of interest, down payment, and monthly payment.

Special finance leads are part of our inbound leads plan and include everything you need to start selling from day one.

We have no contracts or long-term commitments. You can buy as many leads as you want on our pay-as-you-go plan.

Real-time subprime car sales lead generation with no contracts

We generate fresh and exclusive special finance car sales leads for franchise, independent, and BHPH car dealers

A subprime auto finance lead application is a loan app to finance the purchase of a vehicle. It is usually offered to customers who have a poor credit rating or limited credit history. Subprime loans have higher interest rates than other types of loans and may also have prepayment penalties if the borrower decides to pay off the loan before the maturity date. Since subprime borrowers often have limited options, they are prepared to settle for any financing terms to buy a car.

In recent years, the subprime auto loan lead market exploded as many car dealerships sought out customers who were willing to pay higher interest rates on car purchases. These customers are called subprime auto leads due to the fact that their auto credit application would be rejected by mainstream lending institutions. But if you are a car dealership looking for subprime car sales leads, these customers could be your perfect target market.

To a dealership, higher profitability is a given benefit of subprime car loans. The customers who agree to these types of loans are willing to pay higher interest on top of the no-negotiation price of the vehicle. Many finance auto lead providers use networks of websites to capture customers' information and then resell that information to participating car dealers. The biggest problem that you will encounter if you choose to work with special finance leads is fake contact information. Because credit application websites are optimized to capture as many leads as possible, some applicants don’t take the process seriously and enter the wrong contact information to “test” the application results. This fake submission is then sold to you as a lead.

This is why we caution our clients on investing their entire marketing budget into special financing auto lead programs. Even though lead providers might have good intentions of generating quality sales leads for your dealership, clients filling out these lead forms might not.

Our solution is very different from special finance leads. Rather than trying to convince potential buyers to fill out a form on a credit application website, we find people who are already in the market. We do this by looking at all the people selling their current vehicle on a local classified website or social media, signaling a buying or trading behavior. Your dealership will then reach out to these car sale leads and invite them to your store for a trade-in appraisal and a new replacement vehicle presentation. Life-changing events happen all the time, and if your dealership is willing to invest a little bit of effort in working with these customers, you can dominate your local market.

Spend your time working with real in-market subprime car buyers

Car dealers use our technology to diversify their portfolio of special finance car lead sources and close more deals with our subprime car sales leads

Being involved in auto sales can be a tricky position as you seek to find customers who are willing to purchase a new or used vehicle. Over the last few years, subprime auto leads have come to the forefront of the auto industry, giving salespeople a chance to target those who are interested in purchasing a vehicle and providing the tools to do just that. While there are huge benefits to going this route, it’s also becoming obvious that subprime auto leads may not be as good as advertised. Keep reading to discover if subprime auto leads are right for you or if your team needs to take an alternative direction to target potential customers.

What are subprime auto leads? Subprime auto leads or special finance leads are lists of potential automobile buyers provided by a company. These special finance leads provide the names and contact information of individuals who are interested in purchasing a car but do not have good enough credit to secure a loan. When working with subprime auto leads, the salesman contacts the individual and then offers to sell them a vehicle with financing that will meet their specific needs. Special finance leads generally require customers to provide a higher down payment along with higher interest rates. The benefit of special finance leads is that the consumer gets a vehicle while the salesperson receives a larger amount of money spread out over time.

Why should you consider subprime auto leads for your dealership? Special finance leads are, in theory, a fantastic option for dealerships. Not only do they provide a list of potential customers who are desperate to purchase a new car, but they ensure that the dealership can bring in extra money since they will be the ones financing the purchase with higher interest rates.

Why should you NOT buy subprime auto leads for your dealership? While the lure of higher interest rates and better sales certainly is appealing, there are several reasons why these special finance leads should be avoided. Although most companies ensure that you’re the only one who will get the names of these potential customers, the truth is that the lists are generally passed around to all dealerships in the area – you’ll be contacting the same individuals who have already spoken with countless other salespeople. Also, the information generated through subprime auto leads is often outdated and worthless. People with bad credit often change phone numbers and addresses to escape other creditors; by the time you receive their information, it will have likely changed. While special finance leads seem like a great option for dealerships, in the end, they generally cost more than they are ever worth.

We are proud to offer dealerships with a better option for targeting and connecting with potential buyers. Rather than collecting outdated information about those with bad credit, we use software that searches the internet for those who are in the process of selling their current car. Individuals who are selling their vehicles are usually looking for something new. We gather their contact information so that you can target them and offer them a trade-in deal.

While special finance leads seem like a great option, they provide poor results. Use our software to generate leads that will truly make sales and help your dealership generate revenue!

GENERATE SUBPRIME CAR SALES LEADS ON-DEMAND

OUR SUBPRIME AUTO LEADS WORK WITH TRADITIONAL SUBPRIME LENDING PROGRAMS AND BUY HERE PAY HERE DEALERSHIPS

We work with franchise, independent, and Buy Here Pay Here dealerships. Our inbound special finance leads will get you in front of more customers you can sell to today.

If you own a Buy Here Pay Here lot, you may already realize that the old lead generation methods that worked for you a long time aren't cutting it today. Now, savvy owners use buy here pay here marketing that's strategic and targeted. If you feel like it's time to try a new way of advertising, aim to get higher-quality leads that convert into more profitable results.

Buy here, pay here leads are different from prime car sales leads. Before you move forward with any form of advertising or marketing, take another look at your target audience's profile. Buy here pay here leads are consumers who are in a lower-income bracket. Their credit history is poor or insufficient to purchase an affordable vehicle from a franchise car dealership. If you clearly state "bad-credit financing available" or "low-biweekly payments," they'll see that your business is trying to help them buy a vehicle the no-hassle way.

LeadLocate’s online advertising generates buy here pay here leads at an affordable price and at an unbeatable speed. Economical advertising is the benefit of going digital in your buy here pay here marketing efforts. With digital marketing, reaching your target audience can go beyond traditional geographical limitations. We help you optimize your dealership marketing to target buy here pay here leads within 48 hours of signup. Regardless of their income level, everyone uses some form of mobile device, such as a smartphone or tablet. For Americans in the low-income demographic, they are the most likely to use their smartphone to go online. A home computer or internet connection isn't as affordable in many buy-here-pay-here target markets.

From research, we can tell that Facebook is one of the most utilized social media platforms by buy here pay here dealership customers. Facebook is also a low-cost way for businesses to place targeted advertisements. For instance, one way to optimize buy here pay here marketing is to create a boosted post on Facebook. Boosted posts show on your target audiences news feed. Try it by creating a post and place your advertising link in it. You select the criteria for your target audience and set your budget.

With PPC advertising, you can reach your target audience when they enter certain keywords in search engines like Bing, Yahoo, and Google. Try PPC advertising by outbidding other advertisers on the keywords you want to use. After you win the bid, you'll pay that price when someone clicks on your advertisement. The great news is that you set your advertising budget before you begin.

LeadLocate also helps you convert buy here pay here leads into real deal on the books. Manage your leads with included CRM software. We have everything in place for your buy here pay here marketing so that you're ready to handle new leads while they're fresh. If they go stale, you could lose them.

Email is a great way to communicate with your leads, especially if they just have a simple question. If they are in the market to buy a vehicle, you want to get them to your lot as soon as possible. Make follow-up a priority. Instill a policy that gives your salespeople a maximum of 30-minutes to get in touch with a lead. In slow times, use your CRM to revisit past car sales leads to generate new interest. Never be complacent. Set up new ad campaigns to generate new car sales leads. Create lead generation goals and always work your buy here pay here strategies to gain new customers.

Los Angeles Offices

Los Angeles, CA 90071

SACRAMENTO OFFICES

Sacramento, CA 95811

Palm Desert Offices

Palm Desert, CA 92260

WE HAVE THE TOOLS AND THE TALENT TO HELP YOU SUCCEED

GIVE US A CALL TODAY!

CALL OR TEXT: 844-376-2274

If you are a hardworking sales professional or a sales manager, we want to work with you! Our sales lead generation technology will help you work smarter, generate more leads, and streamline your day-to-day sales operations at your organization.

Please give us a call and ask to speak to any available account managers. If you would like us to give you a callback, please submit a request on our "Contact Us" page.

- Call Us Now: 844-376-2274

- Request a Callback: Contact Us

GENERATE LOCAL SPECIAL FINANCE AUTO SALES LEADS ON DEMAND

In today's market, not every car shopper has a perfect credit score. Offering financing to clients with subprime credit scores is a sure way to capture market share and generate more revenue for your store.

At LeadLocate, we are committed to offering our dealer partners the most effective subprime lead generation technology on the market today, and that starts with source transparency. When you open a subprime lead generation account, we will configure our software backend to target specifically car shoppers who are showing interest in getting a loan as second-chance credit borrowers. We use an omnichannel lead generation strategy targeting these shoppers across the web with messages that are relatable to individuals who know they cannot qualify for prime tier A credit auto financing.

The leads are captured from search engines, in-app advertisements, video ads, for-sale-by-owner retargeting, special finance landing pages, and many other sources. LeadLocate software is also capable of synchronizing and processing your current leads through our channels if you want to manage all of your leads in one place. Plus, you get all the marketing and CRM features that you could possibly need included with every subscription. And if you want our finance leads pushed over to your own CRM, this can be easily done through the settings page of your account in one click.

Our special finance auto leads are everyday car shoppers looking to purchase a daily driver. The main objective of our process is to capture car shoppers that you would have otherwise missed. That is why we concentrate on the mass market and set up prescreening process questions that will help you weed out tire kickers and visitors who are just looking around. And with our quality control procedures, you can be sure that any bad leads that you receive do not count against your lead count for that month. To sign up for an account, just click on "sign up" at the top of our website and submit your application. It will take us about 3-4 business days to set up your account, and when your account is fully activated, one of our account managers will give you a call to schedule your first training call to show you around the software.

LEAD FORMS & APPLICATIONS

Each lead has multiple ways to contact you through forms, full credit applications, SMS, chat, or phone calls. This way, clients use the channels they are most comfortable with.

KEEP THE PROCESS MOVING

As soon as you get a lead, you can start the sales process online by collecting any stips, like proof of income or employment verification, before the client gets to the dealership.

CLOSE DEALS ON THE GO

You can access and manage your LeadLocate account on your computer or mobile phone 24/7, giving you unmatched flexibility to sell more cars whether you are at the dealership or on the go.

SUBPRIME CAR SALES LEADS FOR DEALERS WITH SPECIAL FINANCE DEPARTMENT

Let us help you supplement your current subprime auto leads with in-market car shoppers looking for second-chance credit dealers and lenders.

As a car dealership owner, sales manager, or salesperson, you are constantly looking for people who are in the market to buy a car. And even though you use local advertising to bring in buyers who qualify for prime loans, this still isn’t enough business. This is where subprime car sales leads come in.

What are subprime car sales leads? Subprime auto leads are the names and personal contact information of people who are currently looking for a car but have poor enough credit that they cannot get a traditional loan. However, they do have good enough credit to get a subprime car loan. A subprime car loan is a higher-interest loan that requires a larger down payment from the buyer and is paid over a longer period of time.

This allows a person with bad credit to buy a car. They fill out an application online with their current information, which can include their email address, physical address, phone number, and current employer. This information is then sold to local car dealerships through a lead broker so the salesperson can contact them and get them to purchase a car.

Why would dealerships consider buying subprime car sales leads? Subprime car sales leads open up a whole new market for car sales. What could possibly be better than having local leads of people who qualify for subprime car loans and are motivated to buy a car? For a car dealership that needs sales, buying subprime car sales leads seems like a great idea. However, the information these companies are promising to sell you may not only be unhelpful but may also be inaccurate. Here are three problems you will encounter when you buy subprime car sales leads.

One of the things that these sales lead companies will tell you is that the sales leads in your area will only be sold to you exclusively. This may be true in theory, but what you may be buying is a list of names that have already been sold to every dealer in your state.

This is because auto sales lead companies get their leads from many, many different websites where a person who is desperate to get a car loan will give their information over and over to different application sites. So many local dealers will be contacting these people, whose names have been given out to other sales leads companies and sold to many other dealers over and over again as these people apply for loans on different websites.

Another problem is the accuracy of the information. People with bad credit tend to move a lot and often get their phones shut off. So, by the time you get the information, you probably won’t get a hold of anybody. Remember, these people are all running from creditors like you.

Finally, the sales lead company also has no way of knowing whether the person has purchased a car somewhere else or if their situation has changed and they are no longer looking for a car because the sales leads may be several months old or more. And there is also no guarantee this person has any money to make car payments, anyway.

Be careful when buying subprime auto leads from lead generation companies. In your area, how many people with bad credit do you think are looking for a car right now that you can actually help to make a purchase today? Do you have a ballpark figure? If so, when a lead company promises to give you many more leads than what you know is out there, they are probably giving you leads that are not as good as advertised.

REAL-TIME

INBOUND LEADS

Month-to-Month Service

✅ Inbound Plans include integration with our advertising feeds that generate leads for you.

Generate fresh sales leads, get a personal website, capture leads through a referral link, automate marketing, and more.

MARKETPLACE

PROSPECTING

Month-to-Month Service

✅ Prospecting Plans include custom feeds for FSBO, organic, and sponsored seller leads.

Includes everything you need to buy vehicles directly from private sellers to resell on your lot or wholesale at an auction.

ALL-IN-ONE

HYBRID PLAN

Month-to-Month Service

✅ Hybrid Plans include both buyer and seller lead feeds with complete market coverage.

Talk to motivated sellers and generate exclusive buyer leads simultaneously with seamless pipeline management.

SETUP YOUR OWN LEAD CAPTURE PRESCREENING QUESTIONS

YOU CHOOSE WHAT QUESTIONS WE ASK YOUR LEADS DURING LEAD CAPTURE

FAST SPECIAL FINANCE CAR SALES LEADS

READY TO SWITCH YOUR SUBPRIME AUTO LEAD PROVIDER? TRY LEADLOCATE INSTEAD

OMNICHANNEL TECHNOLOGY

We use omnichannel marketing technology to find local subprime car sales leads. You pay a flat fee per month with no surprises.

DIGITAL RETAILING SOFTWARE

Our digital retailing software is included with every subprime car leads account, so you can start selling cars from day one.

BUY MORE LEADS ON-DEMAND

Our subprime car sales leads are generated through a mix of paid and organic advertising targeting active in-market shoppers.

We verify that the customer is actively shopping for a vehicle. Every lead will be a live in-market car shopper looking to buy.

Every lead is exclusive and is generated for a specific account only. Leads are not sent to multiple dealerships or salespeople.

Inbound special finance leads work great for both internet subprime department and Buy Here Pay Here dealerships.

Our CRM system will instantly follow up with the lead for you, so you don't have to worry about manually sending the first message.

All lead replies are instantly pushed to your cellphone, so you will never miss a text or a call from your customer again.

We capture all the information you need to know to start a conversation, like the vehicle of interest, down payment, and monthly payment.

Special finance leads are part of our inbound leads plan and include everything you need to start selling from day one.

We have no contracts or long-term commitments. You can buy as many leads as you want on our pay-as-you-go plan.

REAL-TIME SUBPRIME CAR SALES LEAD GENERATION WITH NO CONTRACTS

WE GENERATE FRESH AND EXCLUSIVE SPECIAL FINANCE CAR SALES LEADS FOR FRANCHISE, INDEPENDENT, AND BHPH CAR DEALERS

A subprime auto finance lead application is a loan app to finance the purchase of a vehicle. It is usually offered to customers who have a poor credit rating or limited credit history. Subprime loans have higher interest rates than other types of loans and may also have prepayment penalties if the borrower decides to pay off the loan before the maturity date. Since subprime borrowers often have limited options, they are prepared to settle for any financing terms to buy a car.

In recent years, the subprime auto loan lead market exploded as many car dealerships sought out customers who were willing to pay higher interest rates on car purchases. These customers are called subprime auto leads due to the fact that their auto credit application would be rejected by mainstream lending institutions. But if you are a car dealership looking for subprime car sales leads, these customers could be your perfect target market.

To a dealership, higher profitability is a given benefit of subprime car loans. The customers who agree to these types of loans are willing to pay higher interest on top of the no-negotiation price of the vehicle. Many finance auto lead providers use networks of websites to capture customers' information and then resell that information to participating car dealers. The biggest problem that you will encounter if you choose to work with special finance leads is fake contact information. Because credit application websites are optimized to capture as many leads as possible, some applicants don’t take the process seriously and enter the wrong contact information to “test” the application results. This fake submission is then sold to you as a lead.

This is why we caution our clients on investing their entire marketing budget into special financing auto lead programs. Even though lead providers might have good intentions of generating quality sales leads for your dealership, clients filling out these lead forms might not.

Our solution is very different from special finance leads. Rather than trying to convince potential buyers to fill out a form on a credit application website, we find people who are already in the market. We do this by looking at all the people selling their current vehicle on a local classified website or social media, signaling a buying or trading behavior. Your dealership will then reach out to these car sale leads and invite them to your store for a trade-in appraisal and a new replacement vehicle presentation. Life-changing events happen all the time, and if your dealership is willing to invest a little bit of effort in working with these customers, you can dominate your local market.

SPEND YOUR TIME WORKING WITH REAL IN-MARKET SUBPRIME CAR BUYERS

CAR DEALERS USE OUR TECHNOLOGY TO DIVERSIFY THEIR PORTFOLIO OF SPECIAL FINANCE CAR LEAD SOURCES AND CLOSE MORE DEALS WITH OUR SUBPRIME CAR SALES LEADS

Being involved in auto sales can be a tricky position as you seek to find customers who are willing to purchase a new or used vehicle. Over the last few years, subprime auto leads have come to the forefront of the auto industry, giving salespeople a chance to target those who are interested in purchasing a vehicle and providing the tools to do just that. While there are huge benefits to going this route, it’s also becoming obvious that subprime auto leads may not be as good as advertised. Keep reading to discover if subprime auto leads are right for you or if your team needs to take an alternative direction to target potential customers.

What are subprime auto leads? Subprime auto leads or special finance leads are lists of potential automobile buyers provided by a company. These special finance leads provide the names and contact information of individuals who are interested in purchasing a car but do not have good enough credit to secure a loan. When working with subprime auto leads, the salesman contacts the individual and then offers to sell them a vehicle with financing that will meet their specific needs. Special finance leads generally require customers to provide a higher down payment along with higher interest rates. The benefit of special finance leads is that the consumer gets a vehicle while the salesperson receives a larger amount of money spread out over time.

Why should you consider subprime auto leads for your dealership? Special finance leads are, in theory, a fantastic option for dealerships. Not only do they provide a list of potential customers who are desperate to purchase a new car, but they ensure that the dealership can bring in extra money since they will be the ones financing the purchase with higher interest rates.

Why should you NOT buy subprime auto leads for your dealership? While the lure of higher interest rates and better sales certainly is appealing, there are several reasons why these special finance leads should be avoided. Although most companies ensure that you’re the only one who will get the names of these potential customers, the truth is that the lists are generally passed around to all dealerships in the area – you’ll be contacting the same individuals who have already spoken with countless other salespeople. Also, the information generated through subprime auto leads is often outdated and worthless. People with bad credit often change phone numbers and addresses to escape other creditors; by the time you receive their information, it will have likely changed. While special finance leads seem like a great option for dealerships, in the end, they generally cost more than they are ever worth.

We are proud to offer dealerships with a better option for targeting and connecting with potential buyers. Rather than collecting outdated information about those with bad credit, we use software that searches the internet for those who are in the process of selling their current car. Individuals who are selling their vehicles are usually looking for something new. We gather their contact information so that you can target them and offer them a trade-in deal.

While special finance leads seem like a great option, they provide poor results. Use our software to generate leads that will truly make sales and help your dealership generate revenue!

GENERATE SUBPRIME CAR SALES LEADS ON-DEMAND

OUR SUBPRIME AUTO LEADS WORK WITH TRADITIONAL SUBPRIME LENDING PROGRAMS AND BUY HERE PAY HERE DEALERSHIPS

If you own a Buy Here Pay Here lot, you may already realize that the old lead generation methods that worked for you a long time aren't cutting it today. Now, savvy owners use buy here pay here marketing that's strategic and targeted. If you feel like it's time to try a new way of advertising, aim to get higher-quality leads that convert into more profitable results.

Buy-here-pay-here leads are different from prime car sales leads. Before you move forward with any form of advertising or marketing, take another look at your target audience's profile. Buy-here-pay-here leads are consumers who are in a lower income bracket. Their credit history is poor or insufficient to purchase an affordable vehicle from a franchise car dealership. If you clearly state "bad-credit financing available" or "low-biweekly payments," they'll see that your business is trying to help them buy a vehicle the no-hassle way.

LeadLocate’s online advertising generates buy-here-pay-here leads at an affordable price and at an unbeatable speed. Economical advertising is the benefit of going digital in your buy here pay here marketing efforts. With digital marketing, reaching your target audience can go beyond traditional geographical limitations. We help you optimize your dealership marketing to target buy here, pay here leads within 48 hours of signup. Regardless of their income level, everyone uses some form of mobile device, such as a smartphone or tablet. For Americans in the low-income demographic, they are the most likely to use their smartphone to go online. A home computer or internet connection isn't as affordable in many buy-here-pay-here target markets.

From research, we can tell that Facebook is one of the most utilized social media platforms by buy here pay here dealership customers. Facebook is also a low-cost way for businesses to place targeted advertisements. For instance, one way to optimize buy here pay here marketing is to create a boosted post on Facebook. Boosted posts show on your target audiences news feed. Try it by creating a post and place your advertising link in it. You select the criteria for your target audience and set your budget.

With PPC advertising, you can reach your target audience when they enter certain keywords in search engines like Bing, Yahoo, and Google. Try PPC advertising by outbidding other advertisers on the keywords you want to use. After you win the bid, you'll pay that price when someone clicks on your advertisement. The great news is that you set your advertising budget before you begin.

LeadLocate also helps you convert buy here pay here leads into real deal on the books. Manage your leads with included CRM software. We have everything in place for your buy here pay here marketing so that you're ready to handle new leads while they're fresh. If they go stale, you could lose them.

Email is a great way to communicate with your leads, especially if they just have a simple question. If they are in the market to buy a vehicle, you want to get them to your lot as soon as possible. Make follow-up a priority. Instill a policy that gives your salespeople a maximum of 30-minutes to get in touch with a lead. In slow times, use your CRM to revisit past car sales leads to generate new interest. Never be complacent. Set up new ad campaigns to generate new car sales leads. Create lead generation goals and always work your buy here pay here strategies to gain new customers.

ORDER ONLINE

★★★★★

24/7 Fast Online Sign Up

SKU: 2570 | GTIN8: 2570A

Available to USA clients only

SUBPRIME AUTO LEADS SOFTWARE

Price: $799-$1999

STILL HAVE QUESTIONS ABOUT OUR SERVICES?

LeadLocate® All rights reserved. Other product and company names mentioned herein are the property of their respective owners.

Answers to your questions:

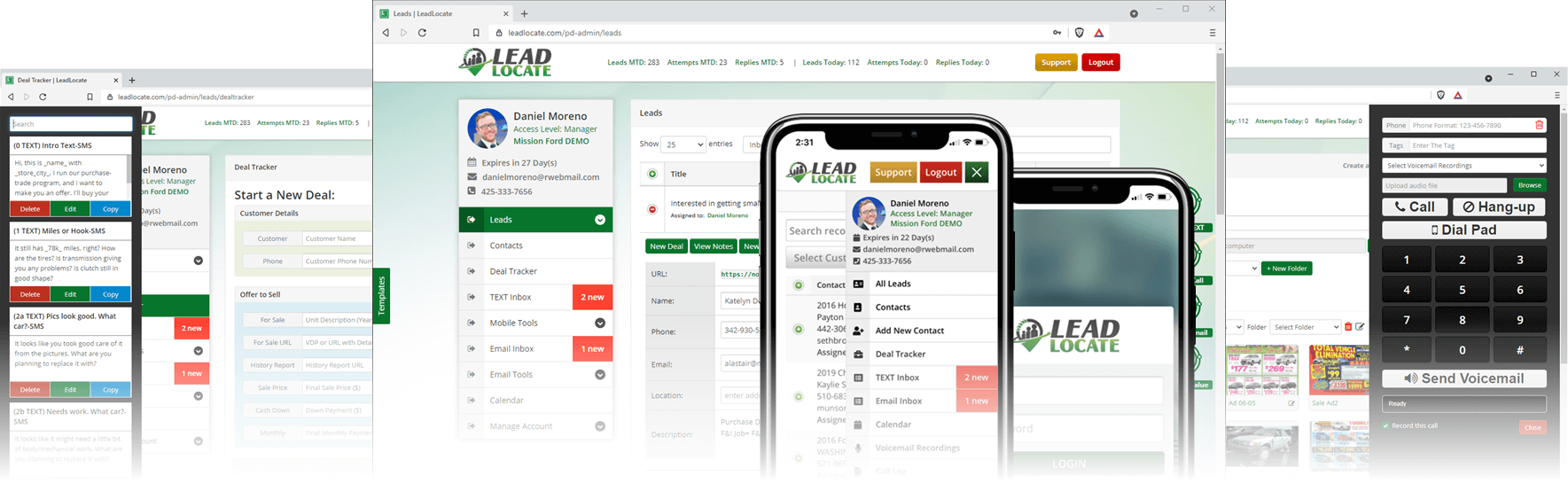

LeadLocate is an all-in-one lead generation software and CRM platform. We generate in-market sales leads and provide you with all the tools necessary to sell that customer. All of your leads, texts, calls, emails, deals, and files are available in one place, accessible with a single login.

LeadLocate® All rights reserved. Other product and company names mentioned herein are the property of their respective owners.

Answers to your questions:

LeadLocate is an all-in-one lead generation software and CRM platform. We generate in-market sales leads and provide you with all the tools necessary to sell that customer. All of your leads, texts, calls, emails, deals, and files are available in one place, accessible with a single login.